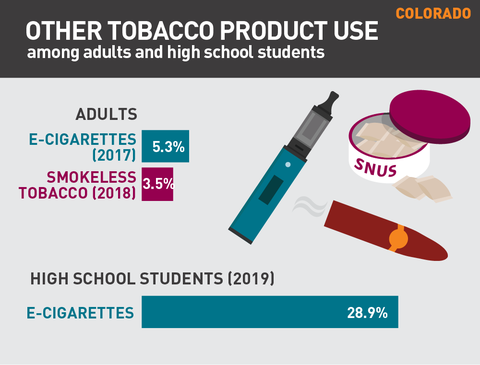

colorado springs sales tax rate 2019

Any sale made in Colorado may also be subject to state-administered local sales taxes. For a Retail Sales Tax License make check payable to the City of Colorado Springs.

Sales Tax Information Colorado Springs

The December 2020 total local sales tax rate was 8250.

. Instructions for City of Colorado Springs Sales andor Use Tax Return 307 Sales and Use Tax Return 307 Sales and Use Tax Return in Spanish January 1 2016 through December 31. Colorado CO Sales Tax Rates by City The state sales tax rate in Colorado is 2900. City of Colorado Springs Sales Tax PO.

The Colorado Springs sales tax rate is. The County sales tax rate is. 187 lower than the maximum sales tax in CO.

The 2018 United States. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county. City of Colorado Springs Sales Tax Contact Information.

If passed the sales tax rate will be lowered from 62 percent to 57 percent beginning in 2021 upon the conclusion of the original voter-approved measure. Colorado state sales tax is imposed at a rate of 29. The Colorado sales tax rate is currently.

Colorado Springs CO 80903 Sales Tax Reports Sales and Use Tax Revenue Reports are prepared and released each month. July to December 2019. Effective January 1 2016 through December 31 2020 the City of Colorado Springs sales and use tax rate is 312 for all transactions occurring during this date range.

The collection month listed below represents the month the revenue. On January 1 2019 numerous local sales and use tax. City of Colorado Springs Sales and Use tax rate is.

Calendar year Discounted rate Regular rate. Groceries and prescription drugs are exempt from the Colorado sales tax. The current total local sales tax rate in Colorado Springs CO is 8200.

The 903 sales tax rate in Manitou Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 39 Manitou. Wayfair Inc affect Colorado. This document lists the sales and use tax rates for all Colorado cities counties and special districts.

The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. Restaurant must charge city tax at the discounted rate for the. Box 1575 Colorado Springs CO 80901.

With local taxes the total sales tax rate is between 2900 and 11200. It also contains contact information for all self. Intended to be substituted for the full text within the City of Colorado Springs Tax Code.

Review Colorado state city and county sales tax changes. Colorado sales tax rate change and sales tax rule tracker. 719-385-5291 Investigator Line.

Sales Tax Breakdown Colorado Springs. Did South Dakota v. Higher sales tax than 74 of Colorado localities 27 lower than the maximum sales tax in CO The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El.

Filing Colorado State Tax Returns Things To Know Credit Karma

Sales Taxes In The United States Wikipedia

U S Cities With The Highest Property Taxes

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Taxes In Colorado Springs Living Colorado Springs

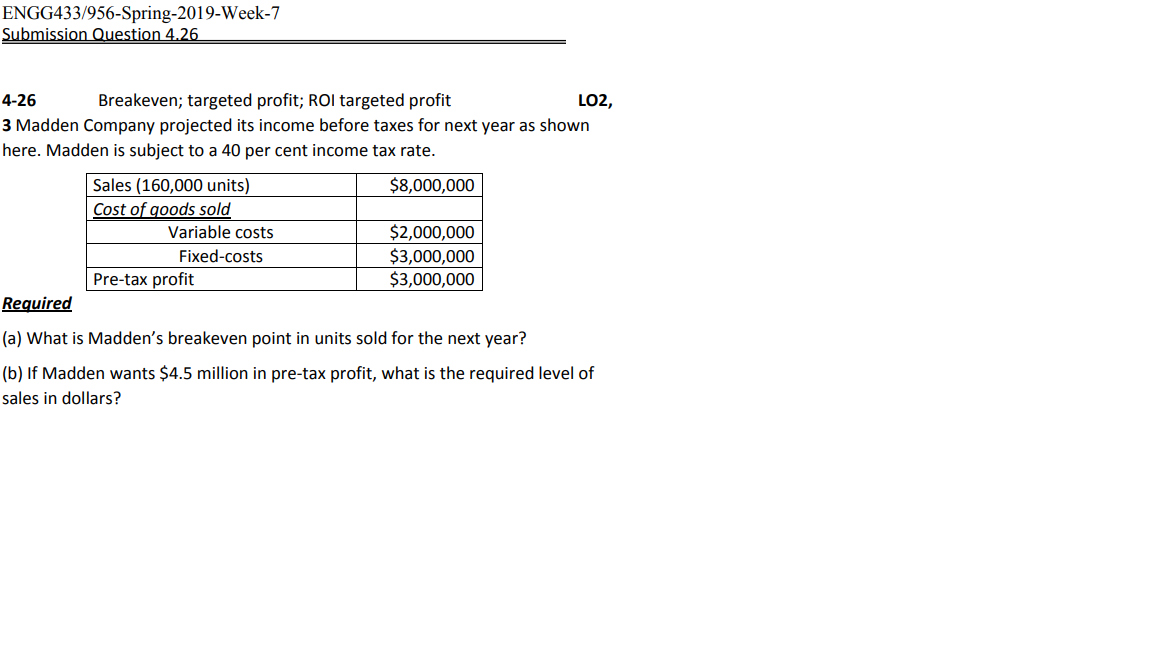

Solved A What Is Madden S Breakeven Point In Units Sold For Chegg Com

Netsuite Sales Tax Sovos For Netsuite Suitetax Demo Youtube

Sales Tax Information Colorado Springs

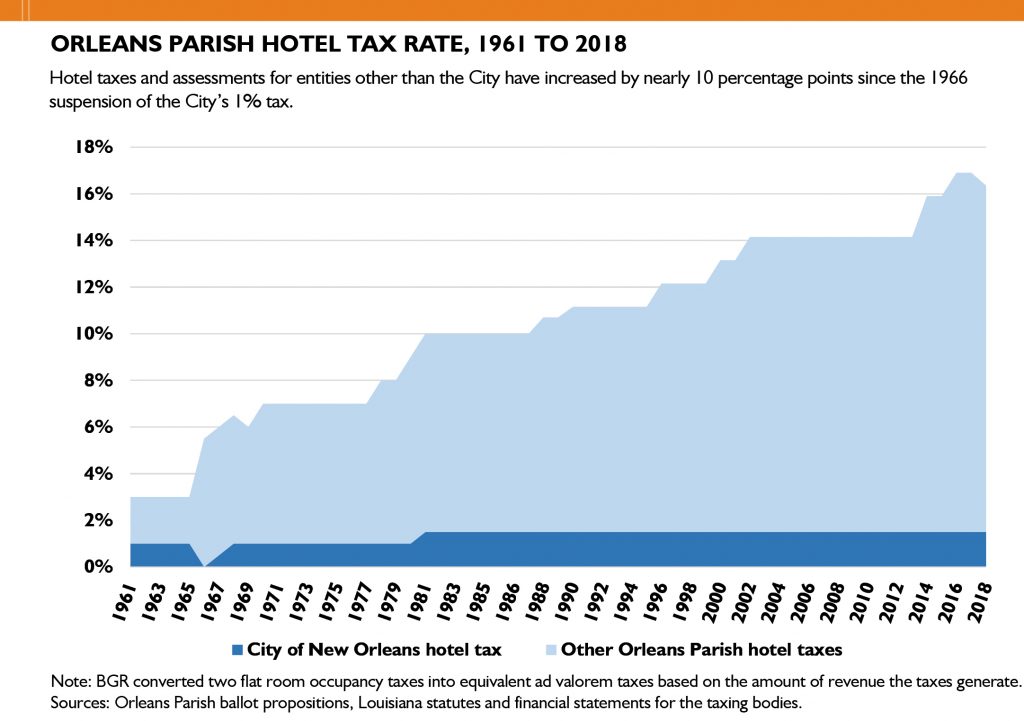

Bgr Analyzes The Orleans Parish Hotel Tax Structure

What Colorado Lawmakers Passed Amended Killed In Legislative Session S Final Days Colorado Newsline

How Colorado Taxes Work Auto Dealers Dealr Tax

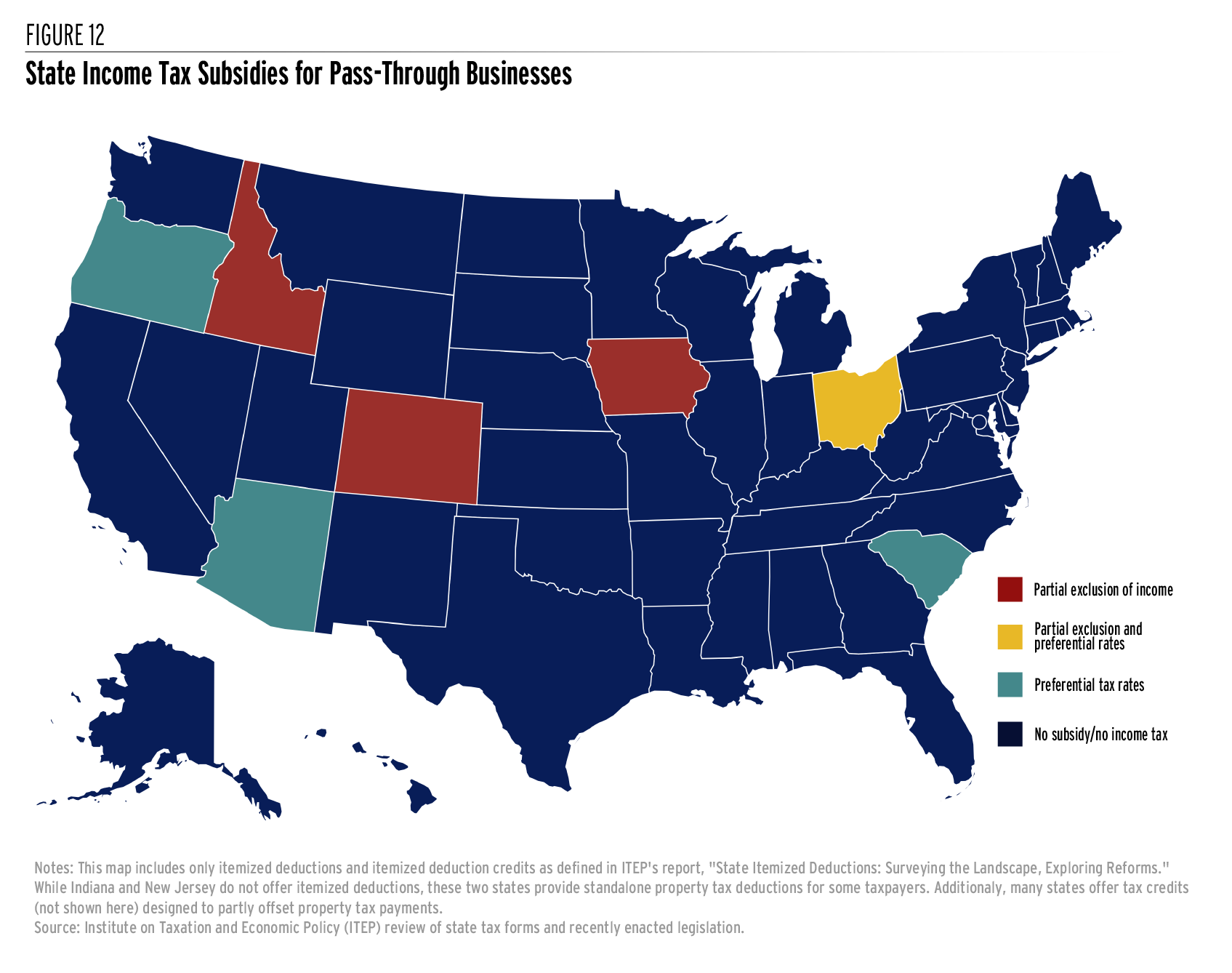

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

What Are Public Improvement Fees Found On Receipts At Local Businesses Restaurants

Sales Tax Training Department Of Revenue Taxation

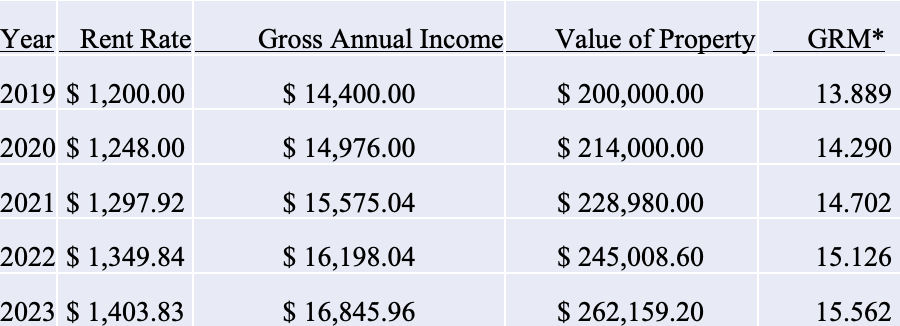

2021 Colorado Springs Real Estate Investing Guide Denver Investment Real Estate

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute